There is no crystal ball when it comes to predicting the book market. That said, we’ve been able to pinpoint certain consumer trends by aggregating data across tens of millions of book titles, geographies, and publishers who publish into different segments. By collecting and analyzing this data, we can better determine how consumers will react to different global shifts in the market.

In part one of this series, we touched on several global trends affecting publishers within the supply chain and book manufacturing. For part two, we’ll focus on consumer behavior.

Despite a dampening effect one year into the pandemic, ecommerce is way up and is continuing in that direction. A significant reason is consumers shifting to online shopping like never before. What started as a necessity or convenience soon became the preferred way for consumers to purchase specific products - including books.

A key trend that caught the eye of many companies in 2021 was value-based shopping. Between Shop Indie campaigns, Black Lives Matter campaigns, and everything in between, it became evident that consumers were more likely to do business with companies, brands, and authors that aligned with their values.

And we see that trend continuing, as shown by a 2022 Customer Loyalty Study across brands (non-book specific). In the study U.S. consumers were asked what keeps them loyal to their favorite brands, with 22% stating a “strong sense of community” and 16% stating a “positive social impact”. In comparison, 17% said “better prices” as a reason to stay loyal to a brand, which showcases just how strong consumer loyalty is tied to the stated and delivered values of a company.

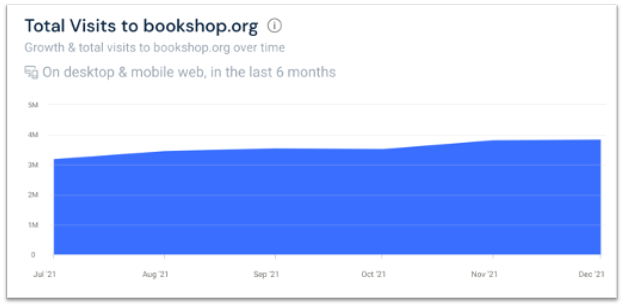

We can also see values-based shopping playing a role in the media growth of bookshop.org from July –December 2021.

Their growth has been consistent and steady, with no sign of falling off like other indie fads over the past two years. We can attribute part of their staying power to their ability to be a part of the community, as a large value prop of bookshop is supporting local bookstores.

According to a Pew Research Center study, the number of U.S. adults reading has barely changed in the last ten years, moving from 78% to 75% - still a large addressable market! Of that market:

From this data, it's clear that print remains the dominant format, however both ebooks and audiobooks essentially doubled in terms of their penetration into the market.

The study also goes on to dispel the myth that an ebook reader exclusively reads ebooks and no other formats, with only 9% of readers report that as being the case. In reality, a third of U.S. adults were shown to have more omnivorous reading habits, reporting to have read both print and digital formats.

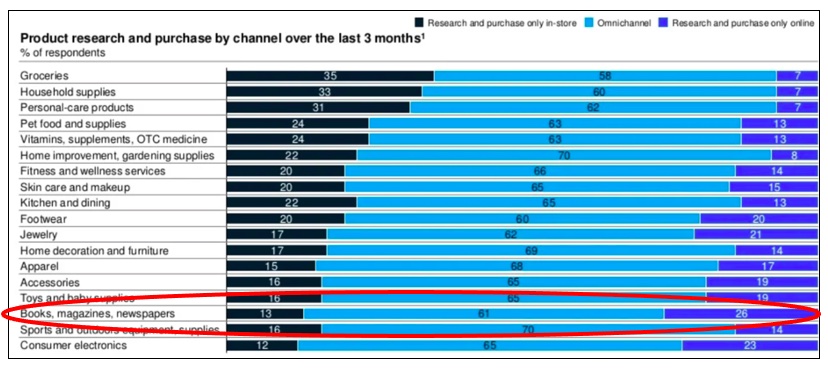

We’ve also seen a new consumer emerge - the omnichannel shopper. They are comfortable buying online and in-store, ebook and print formats, indie bookstores or chain stores - they're multi-format, multi-channel, and multi-retailer within those channels.

According to a McKinsey & Company study done on U.S. shoppers over the summer of 2021, most consumers are shopping in an omnichannel way, doing a combination of online and in-store, which is good news for the book industry. Breaking this down further by those who purchased books, magazines and newspapers, 61% reported purchasing goods online and offline, with only 13% who exclusively research and purchase in-store and 26% who exclusively research and purchase online.

According to NPD, during the first half of last year ebooks were down compared to 2020 by about 5% in unit sales. This may differ slightly from publisher to publisher and within genres, however it does beg the question of whether ebook readership is beginning to stagnate.

NPD also reported ebook unit sales were up 6% over 2019; how is that possible, with so many doubting ebook’s shelf life as a viable option for readers? The answer is streaming.

You won’t find this information reported by NPD, as the streaming platforms empower this data. These transactions are happening in a complicated space for most to truly analyze, but it's a consumer trend we think is significant.

Given the growth of ecommerce, there are a lot of publishers looking to optimize their titles for search within online platforms. However, it's become increasingly difficult to get attention in these crowded spaces organically. To beat out the noise and the clutter of online competition, publishers are utilizing the following tactics:

Your books need to be attractive to grab the attention of a distracted consumer base. The best way to do this is to make sure your books are depicted accurately, with a great description.

Your book descriptions go out into a fractured landscape to be used and shared in many ways. The clearer your descriptions are, the less likely your message can be misconstrued. When consumers arrive, they understand what the book is and how it aligns with their interests.

An attractive book generates action - word of mouth, reviews, brand trust, and more sales.

Publishers are using reader data to work smarter and not harder, by optimizing their books for the consumer path to purchase. The more aggregated data on competitors, search engine result pages, market trends, and reading habits, the better you can understand consumer behavior and whether your sales strategy aligns with it.

Large data sets allow publishers to:

Throughout this two-part blog series, we hope you’ve found the quality data and trends publishers are using allow for more flexibility in the market. One way to ensure you capitalize on these trends is to use a set of consumer marketing tools and services, like the ones Ingram has rolled out in 2022. Click here to learn how these tools help publishers collect and understand reader data.

.png)